We are pleased to provide you with a summary report on the performance of the WCM Quality Global Growth Equity Strategy (the Strategy) in December 2024.

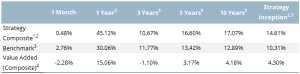

The Strategy1 delivered a return of 0.48% during the month, compared with the benchmark MSCI All Country World Index return of 2.76%. The Strategy has delivered returns in excess of the benchmark MSCI All Country World Index over one, five and 10 years, and since inception.

Strategy Update

Having responded positively to the US election result the previous month, investor enthusiasm waned somewhat in December. This followed heightened concerns regarding the new administration’s tariff policies and comments from Federal Reserve chair Jerome Powell, which raised the level of uncertainty over the future pace and scale of interest rate reductions in the US. However, despite the marginal pullback (in local currency terms) in December, global equity markets closed out their fifth year of double-digit returns. At a regional level, emerging markets beat developed markets as Chinese equities recovered partially from a weak performance in November. In terms of sectors, the better performers included Consumer Discretionary and Communication Services, with the laggards being Energy and Materials. From a factor perspective, it was a positive month for growth and quality relative to value.

The underperformance the Strategy in December after several months of significant outperformance was largely attributed to stock selection, with the weakest performing sectors in this regard being Health Care, Information Technology and Communication Services. In contrast, the portfolio’s Financials sector holdings had the most positive impact on relative performance. The largest positive contribution came from the Strategy’s zero allocation to both Energy and Utilities and above Benchmark position in Information Technology. Sector allocations detracting from relative performance included the overweight exposure to Health Care and underweight allocation to Communication Services and Consumer Discretionary.

Calendar year 2024 marked the 12th out of the 17 years since its inception that returns for the Strategy exceeded the Benchmark index. More significantly, on an annualised basis, the Strategy has also materially surpassed the Benchmark since its inception and since the inception of WQG’s portfolio in June 2017, meaning the outperforming years have more than offset the underperforming ones. This validates the case for the Strategy being best suited for investors with a long-term timeframe who recognise periods of volatility and challenging performance as unavoidable costs of admission. It also validates the robustness of the investment process employed by the team at WCM Investment Management in managing the Strategy. This unique process is based on identifying companies with an expanding economic moat (i.e. a growing competitive advantage) and a corporate culture aligned with this moat trajectory.

Notes: 1. WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) have the same Portfolio Managers and investment team, the same investment principles, philosophy, strategy and execution of approach as those used for the WCM Quality Global Growth Strategy however, it should be noted that due to certain factors including, but not limited to, differences in cash flows, management and performance fees, expenses, performance calculation methods, and portfolio sizes and composition, there may be variances between the investment returns demonstrated by each of these portfolios and the WCM Quality Global Growth Strategy Composite (the Composite) in the future. As WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) have only been in operation for a relatively short period of time, this table makes reference to the Composite to provide a better understanding of how the team has managed this strategy over a longer period. Performance is net of fees and includes the reinvestment of dividends and income. 2. Composite inception date is 31 March 2008. 3. Benchmark refers to the MSCI All Country World Index (with gross dividends reinvested reported in Australian Dollars and unhedged). 4. Value Added equals Composite Performance minus Benchmark performance. 5. Annualised.

DISCLAIMER: AGP Investment Management Limited (AGP IM) (ABN 26 123 611 978, AFSL 312247) is a wholly owned subsidiary of Associate Global Partners Limited (AGP) (ABN 56 080 277 998), a financial institution listed on the ASX (APL). AGP IM has prepared this material for general information purposes only for WCM Global Growth Limited, a listed investment company (ASX: WQG).

AGP IM is the responsible entity for WCM Quality Global Growth Fund (Quoted Managed Fund) (ARSN 625 955 240) (ASX: WCMQ) and WCM Quality Global Growth Fund (Managed Fund) (ARSN 630 062 047).

AGP International Management Pty Ltd (AIML) (ABN 33 617 319 123) is the investment manager for WQG and is an authorised representative of AGP IM. WCM Investment Management, LLC (WCM) is the underlying manager and applies its WCM Quality Global Growth Equity Strategy (the Strategy), excluding Australia, in managing each of WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund)(the Funds). WCM does not hold an AFSL. WQG and CIML are part of the AGP Group.

Any references to ‘We’, ‘Our’, ‘Us’, or the ‘Team’ used in the context of the portfolio commentary, is in reference to WCM Investment Management, as investment manager for the Strategy or CIML as investment manager for WQG.

Even though the Strategy, excluding Australia, is applied to each of WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) certain factors including, but not limited to, differences in cash flows, fees, expenses, performance calculation methods, portfolio sizes and composition may result in variances between the investment returns for each portfolio. The performance of the Strategy is not the performance of the portfolios and is not an indication of how WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) would have performed in the past or will perform in the future.

The material should not be viewed as a solicitation or offer of advice or services by WCM, AGP or AGP IM. It does not contain investment recommendations nor provide investment advice. It does not take into account the objectives, financial situation or needs of any particular individual. Investors should, before acting on this material, consider the appropriateness of the material.

Neither AGP IM, AGP, their related bodies corporate, entities, directors or officers guarantees the performance of, or the timing or amount of repayment of capital or income invested in the Funds or that the Funds will achieve its investment objectives. Past performance is not indicative of future performance.

Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided that the positions will remain within the portfolio of the funds. Any securities identified and described are for illustrative purposes only and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Investors should seek professional investment, financial or other advice to assist the investor determine the individual tolerance to risk and needs to attain a particular return on investment. In no way should the investor rely on information contained in this material.

Investors should read the Product Disclosure Statements (PDS) of the Funds or any relevant offer document in full before making a decision to invest in these products.