We are pleased to provide you with a summary report on the performance of the WCM Quality Global Growth Equity Strategy (the Strategy) in April 2021.

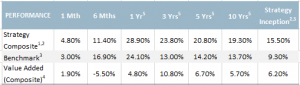

The Strategy1 delivered a return of 4.8% during the month, outperforming the benchmark MSCI All Country World Index (ex-Australia) return of 3.0%. The Strategy has delivered returns in excess of the benchmark over the previous 12-month period, as well as over three years and since inception.

Notes: 1. WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) have the same Portfolio Managers and investment team, the same investment principles, philosophy, strategy and execution of approach as those used for the WCM Quality Global Growth Equity Strategy Composite however, it should be noted that due to certain factors including, but not limited to, differences in cash flows, management and performance fees, expenses, performance calculation methods, and portfolio sizes and composition, there may be variances between the investment returns demonstrated by each of these portfolios and the Composite in the future. As WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) have only been in operation for a relatively short period of time, this table makes reference to the WCM Quality Global Growth Equity Strategy Composite to provide a better understanding of how the team has managed this strategy over a longer period. Performance is in AUD net of fees and includes the reinvestment of dividends and income. 2. Strategy inception date is 31 March 2008. 3. Benchmark refers to the MSCI All Country World Index (with gross dividends reinvested reported in Australian Dollars and unhedged). 4. Value added equals Strategy performance minus Benchmark performance. 5. Annualised.

The Strategy is conveniently available via four investment structures to accommodate the differing preferences of individual investors. You can read the full investment update for each of these products on the links below:

- WCM Global Growth Limited (ASX:WQG) (LIC).

- WCM Quality Global Growth (Quoted Managed Fund) (ASX:WCMQ) (ETMF).

- WCM Quality Global Growth (Managed Fund) (unlisted managed fund).

- WCM Quality Global Growth (Managed Fund) (hedged).

Strategy Update

Global equity markets posted another strong month in April as they continued to benefit from the combination of global fiscal stimulus and accommodative policies from central banks. Markets were given additional support from a strong first quarter corporate earnings season in the US. Aggregate earnings reported to date have comfortably beaten analyst forecasts, leading to upgrades to full year estimates. Economic data from Europe was mixed with the Eurozone technically entering a recession as the economy declined by 1.8%, which was its second consecutive quarter of contraction. The more forward-looking new orders indicator on the other hand pointed to a pickup in future economic activity. There were also conflicting news flows from China where April manufacturing activity showed signs of increased momentum, though the levels were still below those reported for much of last year.

In terms of regional market performance developed markets outperformed emerging, the latter held back by the surge in COVID-19 cases in India and ongoing Chinese political tension. Sector performance was positive across the board led by basic materials and real estate. The energy sector, which has been the top performer year to date, was a relative laggard in April. At a factor level growth outperformed value.

The Strategy had several positions delivering double digit percentage returns in April, with the healthcare and consumer discretionary sectors providing many of these names. The handful of holdings which declined in the month came from a mix of the financials, information technology and industrial sectors.

The value versus growth style debate remains front and centre for many market commentators. WCM’s position on this is clear – ‘if you get the moat trajectory on a great company right and you give it time, the value growth thing really doesn’t matter.’ Whatever the outcome on the current episode of this debate, WCM’s approach will not change. The emphasis will remain on companies with positive moat trajectories, supported by strong well aligned corporate cultures and benefiting from long-lasting tailwinds.

[sc name="post-disclaimer-qgg"]