We are pleased to provide you with a summary report on the performance of the WCM Quality Global Growth Equity Strategy (the Strategy) in May 2021.

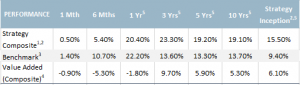

The Strategy1 delivered a return of 0.5% during the month. The Strategy has delivered returns in excess of the benchmark MSCI All Country World Index (ex-Australia) over three years and since inception.

Notes: 1. WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) have the same Portfolio Managers and investment team, the same investment principles, philosophy, strategy and execution of approach as those used for the WCM Quality Global Growth Strategy however, it should be noted that due to certain factors including, but not limited to, differences in cash flows, management and performance fees, expenses, performance calculation methods, and portfolio sizes and composition, there may be variances between the investment returns demonstrated by each of these portfolios and the WCM Quality Global Growth Strategy Composite (the Composite) in the future. As WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) have only been in operation for a relatively short period of time, this table makes reference to the Composite to provide a better understanding of how the team has managed this strategy over a longer period. Performance is net of fees and includes the reinvestment of dividends and income. 2. Composite inception date is 31 March 2008. 3. Benchmark refers to the MSCI All Country World Index (with gross dividends reinvested reported in Australian Dollars and unhedged). 4. Value Added equals Composite Performance minus Benchmark performance. 5. Annualised.

The Strategy is conveniently available via four investment structures to accommodate the differing preferences of individual investors. You can read the full investment update for each of these products on the links below:

- WCM Global Growth Limited (ASX:WQG)

- WCM Quality Global Growth Fund (Quoted Managed Fund) (ASX:WCMQ)

- WCM Quality Global Growth Fund (Managed Fund) (Unhedged)

- WCM Quality Global Growth Fund (Managed Fund) (Hedged)

Strategy Update

Global equity markets in general continued to move higher in May, benefiting from the gradual reopening of economies, the ongoing vaccine rollout and supportive global monetary and fiscal policy. Corporate earnings in the US in its first quarter were another source of positive news with an estimated 86% of S&P 500 constituents surpassing consensus earnings estimates. Inflation remains a key measure, being closely watched by equity market investors. Inflation fears were stoked by a higher than consensus April number in the US and some strong leading indicators of future economic activity including the Purchasing Managers Indices (in both the US and Europe). This strong growth and higher inflation picture provided a backdrop for economically sensitive companies in May. It also led to a relatively stronger month for value sectors such as Financials and Energy. At a regional level European and emerging markets, which have heavier weighting towards cyclical sectors, outperformed the US.

In line with the broader market trend, some of the portfolio’s financial holdings were among the better performing stocks during the month. Likewise, several of the portfolio’s more cyclical consumer discretionary and industrial names outperformed. Portfolio holdings weighing on relative performance could be found in the less economically sensitive, defensive growth sectors such as Health Care.

A recent new addition to the portfolio is Old Dominion Freight Line (ODFL), the fifth largest less-than-truckload (LTL) carrier in North America. WCM Investment Management (WCM) believes ODFL is well positioned to benefit from North American industrial production growth, share gains, pricing power and the longer-term shift to domestic onshoring. The expansion of ODFL’s moat is expected to be driven by: leveraging its scale and reputation; consolidating sub-scale ‘mom and pop’ competitors; and maintaining its lead as the most customer obsessed LTL carrier in the sector.

Equity market investors are becoming increasingly aware of how a poor culture can negatively impact corporate performance and subsequently, shareholder returns. The challenge for investors is how to analyse this factor which for many is so difficult to define, let alone quantify. WCM have long held the view that corporate culture is the biggest driver of sustainable long-term returns. The WCM approach is not simply about identifying ‘good’ and avoiding ‘bad’ cultures. It is about finding companies that have a culture supportive of their competitive advantage. It is this alignment of culture and competitive advantage which enables long-term positive ‘moat trajectory’ i.e. rising returns on capital. WCM’s proprietary framework for identifying such companies has been a key to the impressive performance of the underlying WCM Quality Global Growth Strategy since its inception in March 2008.

[sc name="post-disclaimer-qgg"]