We are pleased to provide you with a summary report on the performance of the WCM Quality Global Growth Strategy in November 2020.

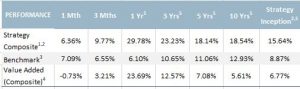

Notes: 1. WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) have the same Portfolio Managers and investment team, the same investment objective and use the same philosophy and strategy as the WCM Quality Global Growth Strategy. As WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) have only been in operation for a relatively short period of time, this table makes reference to the WCM Quality Global Growth Strategy Composite (the Composite) to provide a better understanding of how the team has managed this strategy over a longer period. 2. Composite inception date is 31 March 2008. 3. Benchmark refers to the MSCI All Country World Index (with gross dividends reinvested reported in Australian Dollars and unhedged). 4. Value Added equals Composite Performance minus Benchmark performance. 5. Annualised

The strategy is conveniently available in four investment structures to accommodate the differing preferences of individual investors. You can read the full investment update for each of these products on the links below:

- WCM Global Growth Limited (ASX:WQG) (LIC).

- WCM Quality Global Growth (Quoted Managed Fund) (ASX:WCMQ) (ETMF).

- WCM Quality Global Growth (Managed Fund) (unlisted managed fund).

- WCM Quality Global Growth (Managed Fund) (hedged).

The portfolio delivered a return of 6.43% during the month, slightly below the benchmark MSCI All Country World (ex-Australia) Index return of 7.14%. The portfolio has delivered returns in excess of the benchmark over the previous three, six and 12 month periods, as well as over three years and since inception.

Having moved sideways over the two preceding months, global equity markets sharply advanced higher in November. Despite the legal challenges filed by the Trump campaign team, the apparently large margin of victory for Joe Biden removed the major cloud of uncertainty which had been overhanging markets. The likelihood of the Republicans retaining the Senate, thus ensuring a divided Congress was also taken positively by markets. The major driver of the strong returns in November however came from the announcements of three effective vaccines for COVID-19. The news of light at the end of the tunnel in the fight against the virus far outweighed the concerning rising case numbers, deaths, and poor economic data from Europe and the US. While all major equity sectors and geographical regions posted positive returns, it was the year-to-date laggards such as Energy, Financials and European Equites, which performed best. Consistent with the ‘risk-on’ theme of markets generally, the Australian dollar strengthened during the month, moderating returns for unhedged portfolios.

The outperformance of value versus growth stocks was a headwind for the portfolio in November. Individual stock performance within the portfolio reflected that of the broader market. Financial sector holdings such as Indian bank HDFC Bank and multinational insurer AIA Group, which have lagged the market year-to-date, outperformed. Aerospace and electronics company HEICO Corporation, water treatment group Ecolab and Latin American ecommerce firm MercadoLibre also contributed positively to the portfolio’s relative return. The portfolio’s defensive holdings such as medical device firm Boston Scientific Corporation and life science instrumentation group Thermo Fisher Scientific were amongst the underperformers during the month.

The combination of the positive vaccine news and ongoing expansionary global monetary and fiscal conditions has raised expectations of a significant economic rebound in 2021. This in turn has many market commentators predicting that the recent rotation away from growth stocks towards value and cyclical sectors may be sustainable. A sustained rotation of this kind may create challenges for growth-oriented portfolios including the WCM Quality Global Growth strategy. However, these challenges will be greatest for those portfolios exposed to secular growth stocks only. WCM’s disciplined portfolio construction process ensures that its strategy is always diversified across three growth ‘buckets’, being: secular growth (e.g. Shopify, MercadoLibre and Tencent Holdings), defensive growth (e.g. Pernod Ricard and Costco Wholesale Corporation) and cyclical growth (e.g. Atlas Copco and HEICO Corporation). This diversification reduces the drag on relative returns during times when growth and quality style investing is out of favour, as was the case in November, and has proven to be successful over the long term.

[sc name="post-disclaimer-qgg"]