We are pleased to provide you with a summary report on the performance of the WCM Quality Global Growth Strategy in October 2020.

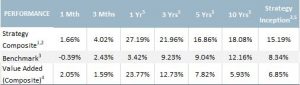

Notes: 1. WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) have the same Portfolio Managers and investment team, the same investment objective and use the same philosophy and strategy as the WCM Quality Global Growth Strategy. As WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) have only been in operation for a relatively short period of time, this table makes reference to the WCM Quality Global Growth Strategy Composite (the Composite) to provide a better understanding of how the team has managed this strategy over a longer period. 2. Composite inception date is 31 March 2008. 3. Benchmark refers to the MSCI All Country World Index (with gross dividends reinvested reported in Australian Dollars and unhedged). 4. Value Added equals Composite Performance minus Benchmark performance. 5. Annualised

The strategy is conveniently available in four investment structures to accommodate the differing preferences of individual investors. You can read the full investment update for each of these products on the links below:

- WCM Global Growth Limited (ASX:WQG) (LIC).

- WCM Quality Global Growth (Quoted Managed Fund) (ASX:WCMQ) (ETMF).

- WCM Quality Global Growth (Managed Fund) (unlisted managed fund).

- WCM Quality Global Growth (Managed Fund) (hedged).

The portfolio delivered a return of 0.93% during the month, outperforming the benchmark MSCI All Country World (ex-Australia) Index return of -0.34%. The portfolio has also delivered returns in excess of the benchmark over the previous three, six and 12 month periods, as well as over three years and since inception.

Global equities recorded a second consecutive month of negative returns in October. Having moved steadily higher over the first half of the month, markets retreated in the final couple of weeks. This was following news of a second COVID-19 wave and consequential lockdowns in Europe. Investors were also disappointed by delays to additional fiscal stimulus in the US. European markets, weighed down by the second wave of COVID-19 infections, led the global equity markets decline. On a brighter note, the Chinese equity market rose over 5.0% as China continued to report positive news relating to its control of the virus and subsequent relatively strong economic data. This rise in Chinese equities was a major contributor to the outperformance of emerging markets relative to developed markets during the month. Sector leaders and laggards were similar to September; Communication Services and Utilities lead the way with the Energy sector again the weakest. At a factor level, value marginally outperformed growth and quality. The weaker Australian dollar over the month dampened the decline for unhedged portfolios, such as the WCM Global Growth Equity Strategy.

Despite the weaker market backdrop, several portfolio holdings rose strongly during the month. These included three of the portfolio’s emerging market stocks: Indian banking and financial services company, HDFC Bank; Chinese multinational technology conglomerate Tencent; and Argentine ecommerce firm MercadoLibre. US private bank and wealth manager First Republic Bank was another strong performer. Medical devices firm Boston Scientific and global payments group Visa were amongst the biggest decliners, as were two portfolio positions whose share prices have more than doubled year to date: Canadian ecommerce multinational Shopify and Dutch payment firm Adyen.

The US presidential election will most likely continue to dominant global news headlines in the coming weeks. Equity market strategists will be busy sharing their views and recommendations on the possible implications of victory for either side. Many money management firms too will be trying to position their portfolios towards those stocks they see to be the winners from the election result. The research team at WCM Investment Management looks through election outcomes in the same way it looks through economic cycles. The team’s focus is on identifying companies it believes can continue to grow their economic moats over the long term, not just over a short term political or economic cycle. The ability to adapt to different circumstances is one of the key cultural traits WCM looks for when identifying these expanding moat companies. An adaptable culture can help see a company through fluctuations in a political and economic environment. WCM’s long term focus and preference for companies with adaptable cultures means the election will have minimal impact on its Quality Global Growth portfolio.

[sc name="post-disclaimer-qgg"]