We are pleased to provide you with a summary report on the performance of the WCM Quality Global Growth Strategy in September 2020.

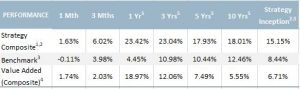

Notes: 1. WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) have the same Portfolio Managers and investment team, the same investment objective and use the same philosophy and strategy as the WCM Quality Global Growth Strategy. As WQG, WCMQ and WCM Quality Global Growth Fund (Managed Fund) have only been in operation for a relatively short period of time, this table makes reference to the WCM Quality Global Growth Strategy Composite (the Composite) to provide a better understanding of how the team has managed this strategy over a longer period. 2. Composite inception date is 31 March 2008. 3. Benchmark refers to the MSCI All Country World Index (with gross dividends reinvested reported in Australian Dollars and unhedged). 4. Value Added equals Composite Performance minus Benchmark performance. 5. Annualised

The strategy is conveniently available in four investment structures to accommodate the differing preferences of individual investors. You can read the full investment update for each of these products on the links below:

- WCM Global Growth Limited (ASX:WQG) (LIC).

- WCM Quality Global Growth (Quoted Managed Fund) (ASX:WCMQ) (ETMF).

- WCM Quality Global Growth (Managed Fund) (unlisted managed fund).

- WCM Quality Global Growth (Managed Fund) (hedged).

The portfolio delivered a return of 1.54% during the month, outperforming the benchmark MSCI All Country World (ex-Australia) Index return of -0.16%. The portfolio has delivered returns in excess of the benchmark over the previous three, six and 12 month periods, as well as over three years and since inception.

September was the first negative month for global equity markets since the COVID-19 pandemic driven decline in March. Commentators pointed to signs of a resurgence in COVID-19 cases in Europe, the potential for a disputed outcome in the forthcoming US Presidential election, and a breakdown in negotiations for additional fiscal stimulus in the US as reasons for the market pullback. Another likely contributing factor was investor profit taking post the exceptional rebound in markets from the March lows. On a more positive note, the global economy showed continued signs of a China-led recovery from its pandemic-induced slowdown. The positive economic news from China contributed to the outperformance of emerging market equities relative to developed markets during the month. At a sector level it was a mix of growth (e.g. technology) and value (e.g. financials and energy) sectors which lead the market lower. The more ‘risk-off’ investor sentiment was also evident in currency markets with the USD ending its five-month losing streak.

It was a relatively ‘quiet’ month for the portfolio with few significant stock price movements in a positive or negative direction. Fluid handling systems firm Graco, contact lens manufacturer The Cooper Companies and Swedish industrial company Atlas Copco were positive contributors to the portfolio’s outperformance. Portfolio holdings that weighed on relative performance included athletic apparel retailer lululemon athletica, medical devices firm Boston Scientific and global payments group Visa Inc.

The hugely volatile markets experienced thus far in 2020 has provided a big test for actively managed portfolios. Many investors have been left whipsawed by the sharp fall in markets in the first quarter of the year and the equally dramatic rebound that followed. A disciplined investment process is key to navigating this volatility. The consistently strong performance of the WCM Quality Global Growth strategy is testament to the strength of WCM’s process and its long-term focus. The first quarter decline presented opportunities to add new, positive moat trajectory holdings that were previously trading at valuations considered too excessive. WCM’s ‘buy and manage’ discipline has also been evident in the past couple of months with the exposure to names such as Shopify being reduced following exceptional strong performance.

[sc name="post-disclaimer-qgg"]