We are pleased to provide you with the January 2025 portfolio report for the WCM International Small Cap Growth Fund (Managed Fund) (the Fund).

Portfolio Commentary

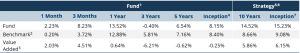

The Fund returned 2.23% during the month, outperforming the Benchmark2 return of 0.20%. The Fund has delivered returns in excess of the Benchmark over one and three months and one year.

Notwithstanding some heightened volatility intra month, global equity markets made a positive start to 2025. This market volatility was sparked by uncertainty over the Trump administration’s tariff policies and the impact of Chinese start-up company DeepSeek on US artificial intelligence (AI) related technology companies. The concern for these companies, which include names such as NVIDIA, is that DeepSeek’s AI program can be run with less advanced computer chips and significantly lower power requirements. Weakness in the technology sector was the primary contributor to the broader US market lagging others, including Europe which was the strongest performing region in January. At a factor level value beat growth during January.

Share prices of small capitalisation companies tend to be more volatile than their larger capitalisation counterparts. Given this inherent volatility, it is important to note that the Fund is broadly diversified, owning 50-70 companies and managed with a long-term horizon of 3-4 years.

One such holding which was added to the portfolio in the December 2024 quarter was South Africa-based OUTsurance Group Ltd. (OUTsurance). OUTsurance engages in direct-to-consumer insurance distribution with a sophisticated underwriting model. This results in better margins and loss ratios compared with peers. Strong fundamentals, combined with expansion into Australia, support a compelling long-term growth story.

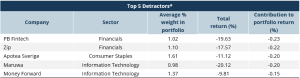

At a portfolio level, the top 5 contributors and detractors in January were as follows:

*The monthly contributors and detractors as disclosed above are for illustrative purposes only and do not represent all the securities purchased or sold. The total sum of securities held within the portfolio drive overall portfolio performance. To request the full securities list including individual security returns and contribution to portfolio performance, please email invest@associateglobal.com.

Notes: All figures greater than 1 year are annualised. 1. Fund performance is in AUD and calculated based on net asset value per unit, which is after management fees, performance fees and expenses and assumes that all distributions are reinvested into the Fund. 2. MSCI All Country World Index ex-US Small Cap USD Gross Total Return Index (with gross dividends reinvested, reported in Australian dollars and unhedged). Benchmark source for Fund is Bloomberg and benchmark source for WCM International Small Cap Growth Strategy (the Strategy) is WCM. 3. Value Added equals Fund or Strategy performance minus applicable Benchmark performance. 4. Fund inception date is 1 August 2019. 5. Due to certain factors including, but not limited to, differences in cash flows, management and performance fees, expenses, performance calculation methods, and portfolio sizes and composition, there may be variances between the investment returns demonstrated by the portfolio and the Strategy in the future. As the fund has only been in operation for a relatively short period of time, this table makes reference to the Composite to provide a better understanding of how the team has managed this fund over a longer period. Performance is net of fees and includes the reinvestment of dividends and income. 6. The Strategy contains fully discretionary Small International Growth equity accounts managed by WCM. There is no account minimum for this composite. SIG total assets are defined to include all client assets managed to the Strategy. Accounts experiencing cash flows equal to or greater than 20% of their value are temporarily removed from the composite during the month in which the cash flows occur. Accounts rejoin the composite the following month. Additional information regarding the treatment of significant cash flows is available upon request. Past performance is not indicative of future results. Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. Returns are presented in AUD terms net of fees (including management and performance fees) and include the reinvestment of all income. Net of fee performance is calculated using actual management fees. The current quarter performance data is preliminary and subject to change. 7. Strategy inception date is 31 December 2014.

DISCLAIMER: AGP Investment Management Limited (AGP IM) (ABN 26 123 611 978, AFSL 312247) is a wholly owned subsidiary of Associate Global Partners Limited (AGP) (ABN 56 080 277 998), a financial institution listed on the ASX (APL). AGP IM is the Responsible Entity for WCM International Small Cap Growth Fund (Managed Fund) (the Fund).

This material has been prepared for general information only. It does not contain investment recommendations nor provide investment advice. Neither AGP IM, AGP, their related bodies corporate, entities, directors or officers guarantees the performance of, or the timing or amount of repayment of capital or income invested in the Fund or that the Fund will achieve its investment objectives. Past performance is not indicative of future performance. Whilst WCM Investment Management (WCM) is the Investment Manager of the Fund and applies its International Small Cap Growth Strategy (SIG) to the Fund, it has not been a party to the preparation of this material.

Any economic or market forecasts are not guaranteed. Any references to particular securities or sectors are for illustrative purposes only and are as at the date of publication of this material. This is not a recommendation in relation to any named securities or sectors and no warranty or guarantee is provided that the positions will remain within the portfolio of the Fund. Any securities identified and described are for illustrative purposes only and do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Investors should seek professional investment, financial or other advice to assist the investor determine the individual tolerance to risk and needs to attain a particular return on investment. In no way should the investor rely on information contained in this material.

Investors should read the Fund’s Product Disclosure Statement (PDS) and consider any relevant offer document in full before making a decision to invest in the Fund. The Fund’s Target Market Determination and other relevant information can be obtained by visiting www.associateglobal.com.